You don't have to be rich to take a trip and have an exciting vacation. By following these tips on how to save money to travel, you will fulfill the dream of your life of going to that special place that you have longed for so much.

Why does going on a trip cost less than you think?

Would you like to travel the world or just take a three or four week vacation in a good international destination? There is a tendency to believe that taking such a trip is only for the rich or for people who have just won the lottery.

Obviously, if you travel first class, stay in an expensive hotel that does not take advantage of half of its facilities and eat in luxurious restaurants, you will need a lot of money.

But you can be creative, take various saving and / or income-increasing measures and make a travel plan that is attractive without being onerous.

Some measures are demanding and involve sacrifices, especially those aimed at cutting expenses and increasing savings.

Others, like learning how to earn extra money, can be valuable learning and an opportunity to improve your financial position for the rest of your life.

The formula to travel is simple and is available to anyone, provided they put effort into it.

How to save money to travel: 12 steps to get it

Saving is not the natural tendency of human beings and most people live from day to day without a reserve fund, not so much because their income is low, but because of the lack of a commitment to saving.

However, if you adopt a disciplined conduct by applying the following actions, you will be able to get the money you need for that trip that you have been longing to do for a long time.

Read our guide on the 12 tips to save money to go on a trip to the place you want

1. Adopt a more financially profitable behavior

We do not mean to criticize you because your finances, no matter how modest, are not as organized as they should be. It is a disease suffered by most of the people.

We do not mean to criticize you because your finances, no matter how modest, are not as organized as they should be. It is a disease suffered by most of the people.

But to become a specialist in how to save money for travel, it will be essential that you adopt a more orderly behavior with your expenses.

Learn to save

School, high school, and college don't teach much about financial planning, unless you choose a career related to economics.

We get used to spending almost everything that comes in and to being frozen with our current situation, without exploring other options to increase the bank balance.

Some people are intuitively good at handling money, the best thing is that this is something that can be learned.

The immediate interest in getting the money necessary to take a trip abroad is an ideal time for you to review or learn basic concepts about planning a personal budget and to get rid of those bad habits that we all acquire along the way.

Take it easy but without pause

Do not imagine that you are in a race of sprint. Rather, it is a background test that will allow you to gain a long-term learning so that you can always make your annual vacation trip, even at some point taking a long season to travel the world.

Many people fail in this endeavor, but it usually happens because they did not make a systematic plan or did not carry it out with adherence. Don't be one of them.

2. Do a rigorous follow-up of your expenses

Is managing your money ineffective? Don't you know how it's slipping away from you? Are you dreading checking the balance of your bank account? Do you manage several accounts, all with a balance close to zero?

Is managing your money ineffective? Don't you know how it's slipping away from you? Are you dreading checking the balance of your bank account? Do you manage several accounts, all with a balance close to zero?

Only the stress that this situation can cause prevents you from starting to take the necessary measures to order finances.

The beginning of the solution is simple: take a day of your free time to do an exhaustive analysis of your expenses in the last month, or preferably, during the last quarter.

Don't make it a chore that you want to finish as soon as possible. Buy yourself a bottle of wine or prepare some cocktails to make the investigation enjoyable.

Prepare the information you will need

There are three common ways to spend money: in cash, on cards (debit and credit) and through transfers.

Card and transfer expenses leave an easy-to-follow electronic footprint, but cash expenses do not.

You will need to write down for a month or during the period of your evaluation your different sources of obtaining cash: ATM withdrawals, allowances, parent loans (the kind that you never pay, but spend) and others.

You will have to write down every expense you make with the money in your pockets. Use the notes application on your mobile or a simple notebook.

Establish how you are spending your money

Once you have all the information, dedicate yourself to writing down all the expenses you have made.

Surely there will be several repeated expenses, for example, coffees, ice creams and lunches on the street, so after writing each one you will have to group them.

The grouping will depend on the pattern of each person, but they must be homogeneous items and with sufficient disaggregation.

In your spending pattern there will be some inelastic and some elastic. The former are those that offer few opportunities to reduce, for example, the cost of the mortgage or the rent of the house.

Focus first on elastic expenses, which offer the greatest chance of reduction. You will surely find savings probabilities at first glance.

This one-day exercise will serve you for a lifetime since, with numbers in hand, you will know exactly where your money is going and you will be able to identify unnecessary expenses.

Read our guide on what to take on a trip: The definitive checklist for your suitcase

Draw conclusions from your spending pattern

Are you spending too much in restaurants? On average, eating out costs three times more than eating at home.

Are you a fan of fitness one of those who go everywhere buying a bottle of water and consume several a day? You could collect several bottles and get used to filling them and refrigerating them at home. The planet and the pocket would appreciate it.

Can you do without Netflix at least as long as your financial war plan is going to last? Can you survive on cell phone plans and Internet cheaper?

Do you have to rush out to buy the latest version of the Samsung or can you extend the life of your “dinosaur” a bit? Are you drinking too much coffee or alcohol?

Are you paying for a gym that you only use five or six days a month? Can you survive for a season with the clothing and footwear that you already have in your closet? Are you too splendid in gifts?

The answers to questions like you are will depend on the success of your travel savings plan.

3. Prepare rigorous budgets

You will have to make two budgets, the one for your living expenses before the trip and the one for your trip.

You will have to make two budgets, the one for your living expenses before the trip and the one for your trip.

Prepare your travel budget

It will depend on the duration and the destination. Nowadays it is easy to find cheap flights to almost everywhere in low season, you just have to check the corresponding portals frequently.

By doing the right thing, it is possible to travel on vacation spending $ 50 on accommodation, meals and other expenses.

Even in the most expensive tourist cities in Western Europe (like Paris and London), you can survive on $ 50 a day. If your destination is Eastern Europe, the prices are more favorable. However, a less stifling budget would be $ 80 per day.

For 30 days, you would need 2400 USD, not including airline tickets.

This implies using accommodations with basic services but without luxuries. It also means eating in modest restaurants and cooking in the accommodation, as well as maximizing the use of public transport.

If your aspiration is to hang up your backpack and go globetrotting for six months, you will need $ 14,400 in your accounts at the time of departure, probably a little less, because long-term trips tend to be cheaper in daily cost than short ones.

Prepare your life budget before the trip

This budget will be subject to the amount of money you will need for the trip and you will have to apply it for as long as it allows you to collect it.

Let's suppose that you will travel for a month in a year, therefore, you will have 12 months to save the required amount.

Let's assume that you will need 3700 USD for the trip, distributed as follows:

- International air ticket: 900 USD

- Travel insurance: 40 USD.

- Living expenses ($ 80 per day): $ 2,400

- Allowance for contingencies (15% of living expenses): $ 360

- Total: USD 3700

It should be noted that this budget does not include a series of expenses that you may have to incur, such as:

- Process the passport: in Mexico it costs 1205 MXN for the 3-year validity.

- Acquiring a backpack: a 45-liter piece costs between 50 and 120 USD, depending on its quality.

- Buy some accessories: the most common are a plug adapter and a bulb.

- Domestic flights.

Set your savings level

Since you have 12 months to raise $ 3,700, you should save $ 310 per month to reach your goal. As you do?

With your spending pattern in hand:

- Set a savings level for each elastic spending item until you reach the total amount of $ 310 per month.

- Check weekly that you are sticking to your spending schedule and make any necessary adjustments.

- Never go shopping "free". If you are going to do the market, establish in advance how much you will spend at most.

- On your group outings, leave the cards at home and spend only what you have planned in cash.

Some measure may seem inappropriate, but it is the only way to achieve the budgeted savings.

This is the time to decide whether to:

- You can do without Netflix for a year.

- The cappuccino in the morning is enough, eliminating the one in the afternoon.

- A couple of drinks are enough on Friday night, avoiding a long day of clubs and bars.

- It is time to apply with a recipe book Internet, preparing some dishes (this will be a learning that will be profitable for a lifetime).

4. Develop saving habits

If you are looking to save to travel the world, the following habits will be useful before, during and after the trip.

If you are looking to save to travel the world, the following habits will be useful before, during and after the trip.

Get up earlier and walk

How about you get up a little earlier and walk to work, saving you the cost of the bus or subway?

Are you driving to work? What if you agree with your colleagues at the office and make a plan to share the cars?

Kitchen

Your vacation savings plan can't be without concrete action on food, which takes up most of your living expenses budget.

Cooking can help you save a fortune compared to eating on the street. You don't have to deprive yourself of the things you like best at your favorite restaurants.

Instead of ordering a delicious avocado toast or carnitas tacos with a coffee or fresh water, learn how to prepare them yourself.

Aside from the savings, eating at home has a healthy advantage: you know exactly what you are packing in your belly.

A full dinner prepared at home can save at least five dollars compared to eating more or less the same on the street. If you replace a meal on the street once a day, we are talking about at least 150 USD per month.

Do "cheap" exercises

Do you really need that expensive gym you're paying for? There are currently tracks of jogging free or low-cost with exercise machines spread out along the way.

If they are not available near your residence, you can also learn an exercise routine online that will allow you to maintain your good physical condition.

It is not the same as a gym, but the important thing is that you stay in good shape while saving for your trip.

Socialize at home

Instead of going out somewhere, organize an evening with friends at your house with shared expenses. They will be able to drink, cook and eat on a much smaller budget.

If the other members of the group do the same, the savings could be huge.

5. Lower your accommodation expenses

When setting measures of how to save money for travel, this may seem extreme, but it is extremely effective.

When setting measures of how to save money for travel, this may seem extreme, but it is extremely effective.

It is possible that you are living in a room to yourself. How about you share it, also sharing the expenses?

Can you move to a smaller apartment or go to another neighborhood that is also safe but cheaper?

Can you go live with your parents while your savings plan lasts? Can you rent your apartment and move to a cheaper one?

These are not the most desirable options and they are not even possible for everyone, but they are there if other measures are not feasible or do not allow to achieve the necessary level of savings.

Making a dream come true may require an uncomfortable action and you must decide whether to adopt it or throw in the towel.

6. Sell what you don't use

A good method of saving to travel requires the greatest possible help in generating new income that increases the travel fund, including the sale of personal items that we can dispose of without trauma.

A good method of saving to travel requires the greatest possible help in generating new income that increases the travel fund, including the sale of personal items that we can dispose of without trauma.

We all have things at home that we use very little or that are simply stored, forgotten or underused.

A bicycle, a guitar, a stick and an outfit of hockey, a second computer, a turntable for DJs, a cabinet ... The list would be endless.

If you do garage or Mercado Libre sales, you can enter a little money that adds more than just change to your travel fund.

7. Get creative in saving

It may not be enough to just make avocado toast at home instead of buying it from the food truck.

It may not be enough to just make avocado toast at home instead of buying it from the food truck.

Buy from the most advantageous sites

It is not enough to start cooking, if you also do the shopping in the most appropriate places, the savings will be greater.

In every city there are places where vegetables, fruits, fish, cheeses and other food are bought cheaper. Find out what they are.

Before you go shopping, take a look at some store portals to see what they have on sale.

Kitchen to refrigerate and freeze

Cooking every day can be tedious, especially for those who have not developed the habit.

If instead of a daily dinner you prepare two on each occasion, eating one and refrigerating or freezing another, you will reduce the time with the apron on by almost half.

This strategy will allow you to save a few hours for other activities and use your kitchen more efficiently.

Rearrange your exits

Among your strategies on how to raise money for a trip, it can be helpful to rethink how you enjoy yourself with your friends.

Instead of spending at the bar, cafe, movie theater, or ice cream parlor, promote cheaper entertainment among your group of friends.

In big cities there are always free or very low-cost cultural shows on the billboard. You just have to be well informed and take advantage of these opportunities.

Cut your landline and ditch your cable

Can't remember the last time you used the landline? Maybe it's time to cut the line and save some money.

How many hours a day do you spend on television? Few? Then buy a cheaper cable plan or just ditch it.

It may be a good time to return to reading as a habit, rereading the books you already have, borrowing from the public library or reading free editions by Internet.

Eliminate sumptuous expenses

It is not true that having the latest version of the smartphone is an absolute necessity. It's a lie that you need new clothes and shoes every month.

Nor is it true that your lips need five or six different colors. The trips to the hairdresser can be reduced without causing a catastrophe in the personal appearance.

Lower your utility bill

Turn off the air conditioning or heating when the ambient temperature allows it. Put various things in the oven and run full loads in the washer and dryer. Take shorter showers.

8. Make more money

Almost all of us have a talent that can be sold to get complementary money to our usual income.

Almost all of us have a talent that can be sold to get complementary money to our usual income.

Even if you already have a full-time occupation, it is always possible to use a few hours of free time to carry out another paid activity without sacrificing too much rest.

Some people can write or teach language classes. Others may be weekend waiters or supermarket cashiers.

Others may sell the tasty cake they know how to make, or take care of a boy during his parents' night out, or work as a photographer at weddings and other celebrations, or animate these gatherings as musicians.

It doesn't have to be amazing work. It is just one way to get a supplemental income.

9. Check your current job

It is amazing how many people are for years tied to a job that is not very well paid, just because of the aversion to change.

It is amazing how many people are for years tied to a job that is not very well paid, just because of the aversion to change.

Do you feel that you are a valuable employee and that the company you work for does not recognize you enough and your income is lower than that of other people with a similar occupation?

Perhaps now is the time to talk to your boss about the possibility of a salary increase or promotion to a higher paying position.

Respectfully let him know that you would consider moving elsewhere if your situation does not improve within a reasonable time. If the company values your services and is afraid of losing you, it will do something to try and retain you.

If your situation remains the same within the established period, investigate the job market for your specialty and see if there is a job that allows you to increase your income.

It is also possible that you will get a new job in which you maintain your income by working fewer hours a week. That time that you now have free can be used in a complementary remunerative activity.

10. Keep travel savings separate

The money that is saved by reducing living expenses or that which comes in from extra work or the sale of personal belongings must go to a separate account, assigned exclusively to the fund for the trip.

The money that is saved by reducing living expenses or that which comes in from extra work or the sale of personal belongings must go to a separate account, assigned exclusively to the fund for the trip.

If all the money is in one account, the chances of using the savings for purposes other than travel are greatly increased.

It is advisable that the savings fund is in an account remunerated with an interest rate, to at least preserve the purchasing power of the money.

Some people even save on financial products in which the money cannot be mobilized for certain periods, as a way of not being able to use the balance even wanting to.

11. Use rewards wisely

Most credit cards offer rewards in points that can be used on flights, accommodation and other tourist expenses.

Most credit cards offer rewards in points that can be used on flights, accommodation and other tourist expenses.

By Internet stories circulate millennials who have supposedly traveled the world with just the points on their cards.

These rewards are unlikely to be able to fully fund a trip, but they are very helpful if points are earned wisely.

The fundamental requirement is that the purchase with the card to earn the points is among the essential expenses and that it is not more expensive than making the purchase with another means of payment.

Overloading yourself on credit cards just to maximize purchases and points may not be a good idea.

12. Try to get a hospitality exchange

The accommodation exchange modality was developed by the portal Couchsurfing, which started out as a non-profit company.

The accommodation exchange modality was developed by the portal Couchsurfing, which started out as a non-profit company.

Through this system, you can stay for free in your destination country, with the condition that you host someone at your opportunity in your own country, also free of charge.

After Couchsurfing Other portals have sprung up to put accommodation trackers in contact.

If you have the possibility of hosting someone and it does not bother you to do so, this can be a measure to cover the cost of accommodation on your trip.

Earn money while traveling

Work on vacation? Why not? If your dream is to go to Paris to see The Mona Lisa,What's the problem with you working a few hours in the morning and going to the Louvre in the afternoon?

This option will depend on what your skills are and how feasible it is for you to use them in a foreign city.

Internet offers multiple possibilities to work as freelancer remotely from anywhere in the world and you would only have to take your laptop or rent one at your destination. Some options are:

- Graphic design

- Virtual assistant

- Language classes

- Writing, proofreading, translation and editing of texts

- Financial, administrative and marketing

- Development of software and computer programming

It will depend on your skills. Are you an excellent musician? Take your guitar and play on a busy street or in the corridors of the subway.

How to save money to travel to Europe

All the measures of saving in living expenses and of increasing income to make a travel fund previously exposed are applicable to go anywhere.

If your destination is Europe, the following are some good tricks to save money to travel around the Old Continent.

Stay in a hostel

In Europe, lodging in hostels is comfortable and safe, if all you need is a good bed and basic services.

In London, Amsterdam and Munich you can get hostels for 20 USD a night, in Paris you can pay 30 USD, 15 in Barcelona and less than 10 in Budapest, Krakow and other cities in Eastern Europe.

Drink wine and beer at the tapas bars

In Europe it is cheaper to drink a glass of wine or a beer than a soda.

In Spain the tapa is an institution. It is a sandwich served with a glass. If you were planning to have a few drinks anyway, dinner can be almost free.

Bottled water is expensive in Europe. Fill your bottle at the hotel and go out with it.

Do the internal trips with the low-end lines

If you are going to take flights within the European continent, it will be much cheaper with “low cost” lines such as Ryanair and Vueling. They have luggage restrictions.

Get around by public transport

In European cities, traveling by buses and subways is much cheaper than taking taxis or renting cars.

A ticket for 10 trips on the Paris metro costs 16 USD. With that amount, you probably won't even pay for a taxi ride in the City of Light.

In the public transport system of Budapest (buses and metro) you can travel unlimited for three days for only 17 dollars.

In Barcelona a metro trip costs 1.4 USD. On the Prague tram you pay 1.6 USD.

Travel in the European low season

If you do not have problems with the cold, you should consider making your trip to Europe in winter, which is the low season.

Between December and March, the winter period in the northern hemisphere, flights to Europe and expenses for stays in the Old Continent (hotels and other tourist services) have lower prices.

The most expensive period to travel is summer, while spring and fall are not as cheap as winter or as expensive as the summer season.

Another advantage is that in winter the most visited cities in Europe (such as Paris, Venice and Rome) are less congested and you can enjoy their attractions with greater comfort.

How to save to go on a trip

As we already said, traveling is a completely satisfying activity that we cannot so easily pass up; And although we may not have enough resources to travel right now, there are always ways to figure out how to pay for a trip.

As we already said, traveling is a completely satisfying activity that we cannot so easily pass up; And although we may not have enough resources to travel right now, there are always ways to figure out how to pay for a trip.

The best way to cover the expenses of a trip is by doing simple saving strategies; for example:

Set aside at least 10% of your salary or whatever income you have.

Save all the 10 peso coins that come into your hands.

Try to get a new form of income (work freelance, sell things you no longer use) and allocate all that money to travel.

But if what you want is to travel immediately or you have just discovered a travel offer that you cannot miss but you do not have enough money, there is a simple way to get it, pay attention.

Get a urgent loan to travel. This is undoubtedly the option to quickly and easily get the money to travel.

Final messages

The formula for how to save money for travel is simple: live a little below your means and save the rest.

The formula for how to save money for travel is simple: live a little below your means and save the rest.

It's not easy and social pressures and hype make it more complicated, so your willpower will have to make the difference between success or failure.

Most of the people who fail in a savings plan with any objective (traveling, buying a car and many others) do so not because it is materially impossible to save part of the income, but because they have lacked the will power to achieve it and have succumbed to nonessential expenses.

It is also possible that you manage to save but not enough to make the trip in the initially contemplated period.

Almost nothing turns out how we had originally planned. Rather, you will be surprised by the amount of things that do not go according to plan. Do not be discouraged, rethink the schedule and adjust the trajectory until you achieve your goal.

Read our guide on how to find the cheapest flights online from anywhere

What is the most satisfactory thing we can do with the money saved?

Of all the things we can do with money, I think traveling is the most satisfying.

Perhaps for other people, material goods are the best way to invest our capital, but although having a house and a car can provide us with security and tranquility, what anecdotes can we tell in our old age?

Well yes, the best investment is to travel, get to know new places, cultures, languages, lifestyles, gastronomy, etc.

Increasing your cultural level will not only allow you to have better topics of conversation, but it will open a door that will take you to another level of happiness: enjoy a good landscape, get to know the most important icons of big cities, etc.

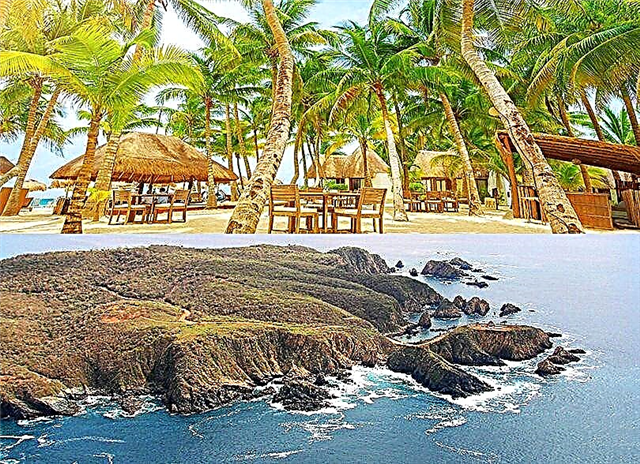

When traveling you will enjoy the true experience of living, because we talk about traveling as something that goes beyond planning your next vacation or deciding the place where you want to rest.

We mean truly living a journey. That is, to climb to reach remote places, to try traditional dishes in the most Creole places and not in elegant restaurants. In short, we are talking about living the true experience of traveling.

Taking a trip is truly amazing in so many ways. It is an experience that captures us by a sense of wanderlust that makes us yearn more and more to know more places and surprising places to know.

We hope that you will be successful in your savings plan and that very soon you will be able to visit that Caribbean island or that European, South American or Asian city in which you will enjoy to the fullest after having made some profitable sacrifices.

Share this article with your friends on social networks so that they also know how to save money to travel, much more if you liked the destinations that we present.